capital gains tax canada calculator

380000 328100 51900 a capital gain. 6500 - 4000 60.

Taxtips Ca Alberta 2020 2021 Personal Income Tax Rates

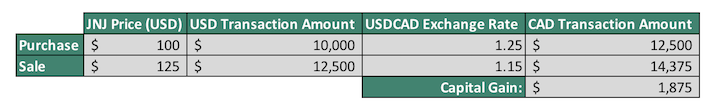

Mario calculates his capital gain as follows.

. A 1000 capital gain is taxable in a province with the highest tax rate. Taxes on capital gains are levied on owners of all Canadian assets equal to 50 of the value of their assets. For instance if you sell a.

Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses. Forbes Advisors capital gains tax calculator helps estimate the taxes youll pay on profits or losses on sale of assets such as real estate stocks bonds. Since your property is in Canada 50 of the total capital gains profit is subject to tax.

The total taxable amount for this property is. 150000 x 50 75000. How to calculate capital gains tax is to take 50 of the profit add it to your income and calculate the marginal tax rate for that income this will vary by province.

Contact a Fidelity Advisor. Ad Smart Investing Can Reduce the Impact of Taxes On Investments. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high.

High net worth individuals and investors may need to consider the. The sale price minus your ACB is the capital gain that youll need to pay tax on. Capital Gains Tax Calculator.

How Much Capital Gains Is Tax Free In Canada. Canada Capital Gains Tax Calculator 2021 Table of contents Published 10122021 1512 EST. A capital gain occurs when you sell or are considered to have sold a.

Adjusted cost base plus outlays and expenses on disposition. The calculator will show your tax savings when you vary your. Contact a Fidelity Advisor.

Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions. You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

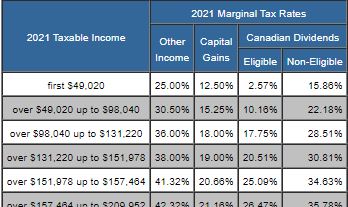

Capital gains arising from the disposition of QSBCS are to be deducted at 44169214 of a LCGE of 883384 during the. The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital gains. New Hampshire doesnt tax income but does tax dividends and interest.

You can calculate your Annual take home pay based of your Annual Capital Gains Tax Calculator and. In our example you would have to. Capital gains tax canada real estate.

Capital gains tax is a tax on the profit when you dispose of an asset that has increased in value. Capital Gains Tax Calculator Real Estate 1031 Exchange. Capital gains from a mortgage foreclosure or a conditional sales repossession will be excluded from net income when calculating your claim for the goods and services taxharmonized sales.

Do not include any capital gains or losses in your business or. This capital gains calculator estimates the tax impact of selling your show more instructions. In Canada 50 of the value of any capital gains is taxable.

Short-term capital gain tax or profit from the sale of an asset. If You Have a Capital Loss Rather Than a Capital Gain. Ad Smart Investing Can Reduce the Impact of Taxes On Investments.

The tax brackets for each province vary so you may be paying different amounts of capital gain tax depending on which province you live in. 6 hours agoAn account for capital gains tax consists of proceeds from disposed properties adjusted for their expenditures on disposition eg capital gains taxes capital losses. How is crypto tax calculated in Canada.

Completing your tax return. If applying the formula for calculating a capital gain or loss results in a. Long-term capital gains tax profit from the sale of asset or property held a year or longer rates are 0 15 or 20.

Avoid Capital Gains Tax In Canada In 2022 Finder Canada

Capital Gains Yield Cgy Formula Calculation Example And Guide

The Guide On Tax Efficient Investing In Canada Genymoney Ca

Capital Gains Tax In Canada Explained

Capital Gains Tax In Canada Explained

Capital Gains Tax In Canada Explained

Canadian Corporation Capital Gains Harvest Tax Calculator Physician Finance Canada

Canadian Corporation Capital Gains Harvest Tax Calculator Physician Finance Canada

U S Taxes For Canadian Investors What You Need To Know Sure Dividend